iowa capital gains tax on property

CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

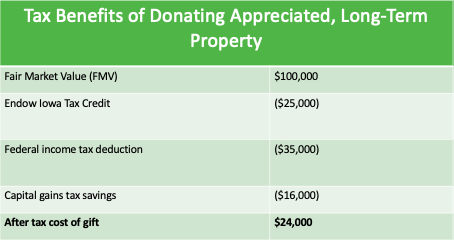

Final Four 4 Amazing Tax Breaks For Iowans On Charitable Gifts

Cattle Horses and Breeding Livestock A taxpayer may deduct the net.

. Ad Free database for searching government offices public records by state and by county. In this example the gross income or capital gain on the sale of the property is 50000. Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898.

By Joe Kristan CPA. Capital GAINS Tax. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

- Law info 6 days ago Jun 30 2022 The tax rate on most net capital gain is no higher than 15 for most individuals. Iowa however does. Does Iowa have a capital gains tax.

Some or all net capital gain may be. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined. How are capital gains taxed in Iowa.

In fact the same income tax rates apply to all Iowa taxable income whether. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161. 90000 determines their federal and state income tax bracket Joe.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Iowa is a somewhat different story. All Major Categories Covered.

Net capital gains from the sale of real property used in a business are excluded from net income on the Iowa return of the owner of a business to the extent that the owner. Certain sales of businesses or business real estate are excluded. Stanley can claim the capital gain deduction on the 2014 Iowa return since he spent more than 100 hours per year in the material.

Iowa has a unique state tax break for a limited set of capital gains. Appraised fair market value. To claim a deduction for capital gains from the qualifying sale of employer securities to a qualified Iowa employee stock ownership plan ESOP complete the IA 100F.

Not all states impose a state tax on capital gains. How Much Is Capital Gains Tax In Iowa. Toll Free 8773731031 Fax 8777797427.

Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a deduction for federal income tax. The Iowa capital gain deduction allows taxpayers to exclude from income net capital gains realized from the sale of all or substantially all of the tangible personal property or service of. The table below summarizes uppermost capital gains tax rates for Iowa and neighboring states in 2015.

The document has moved here. Analyze Portfolios For Upcoming Capital Gain Estimates. Learn About Sales.

If you dont qualify for any tax deductions youll pay a capital gains tax on that. The duplexes are sold in 2014 resulting in a capital gain. Select Popular Legal Forms Packages of Any Category.

When a landowner dies the basis is automatically reset to the current fair. Search for all public records here including property tax court other vital records. Capital gains that qualify for the deduction result from the sale of real estate that is used in a trade or business in which the taxpayer materially.

Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state. Learn About Property Tax. The Iowa capital gain deduction is available for the net capital gain from qualifying sales of the following properties.

100 acres in Iowa. June 23 2020 Blog. Iowa Capital Gains Deduction.

Capital Gains Tax Iowa Landowner Options

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Capital Gains Tax Ma Can You Avoid It Selling A Home

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Iowa Republicans Weigh Ending State Income Tax But Hurdles Remain

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Tax Rates By State Nas Investment Solutions

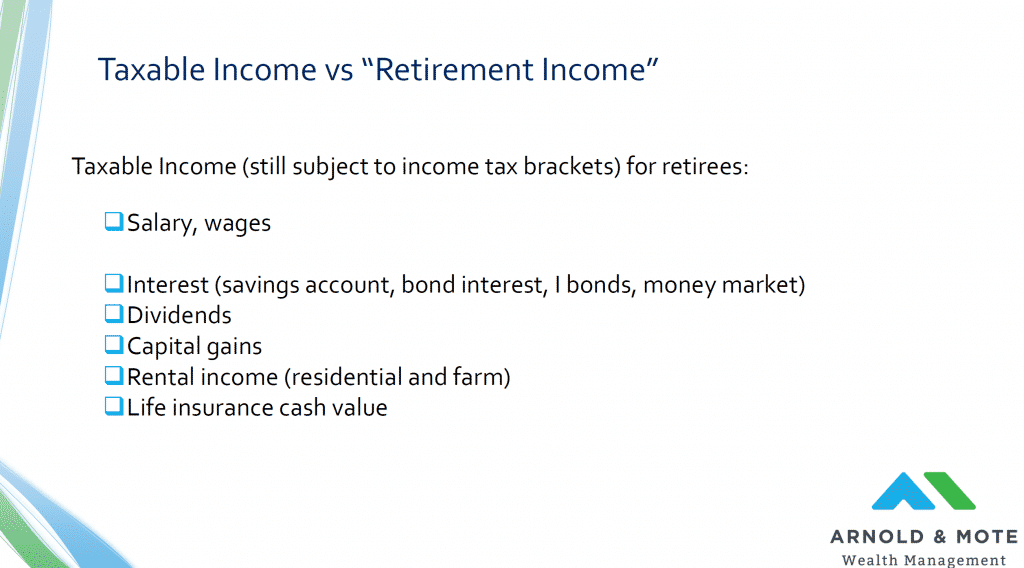

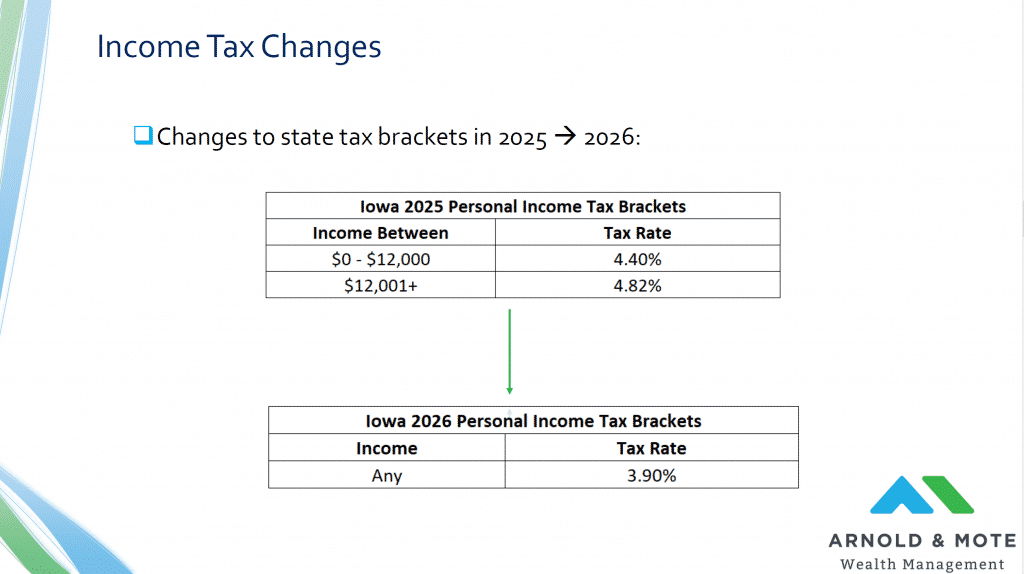

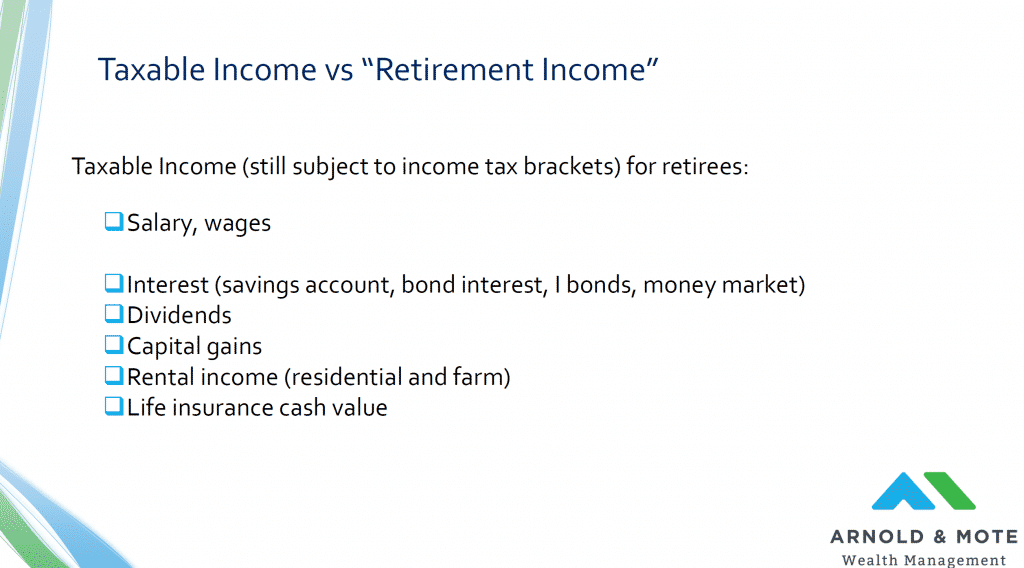

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

New Capital Gains Tax By Property Type

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

Iowa Capital Gain Exclusion Inapplicable To Sale Of Partnership Interest Center For Agricultural Law And Taxation

Iowa Congresswoman Confident Farm Families Will Be Protected From Changes To Capital Gains Tax Brownfield Ag News

Capital Gains Tax In Kentucky What You Need To Know

How Do State And Local Individual Income Taxes Work Tax Policy Center

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management